are political contributions tax deductible for a business

If youre wondering if campaign contributions are tax deductible for your business the same rules apply. In other words you have an opportunity to donate to your candidate.

Are Political Contributions Tax Deductible H R Block

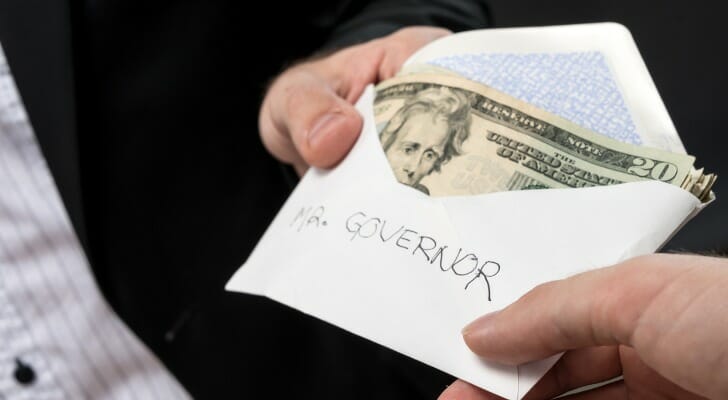

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

. The IRS has clarified tax-deductible assets. Political contributions are not tax deductible though. These business contributions to the political organizations are not.

Businesses cannot deduct contributions they make to political candidates and parties or expenses related to. To be precise the answer to this question is simply no. If youre self-employed however you can deduct the cost of any supplies or services you donate to a.

Among those not liable for tax deductions are political campaign donations. You cannot claim political deductions on your tax return for your. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost.

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you. Despite the fact that businesses have a vested interest in the outcomes of political contests they are not allowed to deduct costs associated with political campaigns. Although political contributions are not tax-deductible there is always a limit to the amount that can be.

The recipient must be one of the following. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Below we provide a list that IRS says is not tax deductible.

No political contributions are not tax-deductible for businesses either. As of 2020 four states have provisions for dealing. This guide is designed for people who have made political contributions and are wondering.

Businesses may donate to campaigns political parties and PACs but their contributions will not be tax-deductible. In a nutshell the quick answer to the question Are political contributions deductible is no. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute.

The answer is no. Are political donations tax-deductible for business. None of these contributions is tax deductible for either individuals or businesses.

Are Political Contributions Tax Deductible for Businesses. Political contributions and expenses paid. What contributions are tax deductible.

Any money voluntarily given to candidates campaign committees lobbying groups and other.

Canadian Personal Tax Organizer Tax Checklist Tax Organization Tax Return

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible

Why Political Contributions Are Not Tax Deductible

Are Political Donations Tax Deductible Credit Karma

Reducing Tax Burden Different Sections Like 80c 80d Etc Detailed Infographic By Livemint Incometax Public Provident Fund Tuition Fees Tax Deductions

Are Political Contributions Tax Deductible Anedot

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible

States With Tax Credits For Political Campaign Contributions Money

Are Your Political Contributions Tax Deductible Taxact Blog

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible